COVID-19: proposals for action to ensure business continuity

On 31 December 2019, the World Health Organisation’s office in China was informed that a pneumonia of unknown cause had been detected in the city of Wuhan, in Hubei province. The new coronavirus, associated with other known viruses such as SARs and MERs, was given the name SARS-CoV-2 while the disease caused by the virus received the name COVID-19. On 30 January, after detecting virus outbreaks in countries other than China, the WHO declared an International Health Emergency.

COVID-19: business continuity

On 11 March 2020, when the number of infections soared to 118.000 cases across 114 countries, the coronavirus was declared a pandemic so that governments worldwide would take the necessary measures to contain its spread. Two weeks later, the impact of the pandemic grew to more than 400.000 confirmed cases of infections by SARS-CoV-2 and over 18.000 deaths in 196 countries. Since then, SARS–CoV–2 continues to cross borders and maintain an exponential growth rate, doubling the number of people infected every few days in many countries.

In order to mitigate the effects related to the spread of the pandemic, governments have been forced to take swift action and adopt emergency measures to contain the virus such as the restrictition of the general public mobility and strengthening border control or closing the borders. The governments of Italy, Spain and France have taken the most restrictive measures thus far.

In addition to causing a major health crisis, this situation has negative consequences for the global economy. According to the International Monetary Fund (IMF), the quantification of the economic impact of the new coronavirus pandemic is complex, generating uncertainty about the economic outlook and the associated risk of deterioration. This may jeopardize both economic growth and financial stability.

As IMF notes, in addition to economic and fiscal measures, the implementation of monetary and financial stability measures will be critical to support the world economy . Hence, governments as well as national (e.g. BoE, Fed) and supranational institutions (e.g. ECB, EBA, ESMA) are taking measures to reduce the negative impact in the real economy, such as the suspension of mortgage payments, flexibility in the deferral of payments for SMEs and self-employed workers, or the increased flexibility of certain supervisory requirements, amongst others. This sort of measures are taken in different degrees in Europe, USA and Latin America.

Finally, the health threat of the spread of the new virus as well as the containment measures taken by the authorities pose a threat to the business continuity of companies.

The sharp decrease of the demand of products and services due to the restriction of general public mobility and the closing of businesses leads to liquidity stress for companies. Some sectors supply chains are also being seriously affected. Furthermore, the compliance with confinement measures implies a higher pressure on the telecommunications infrastructure, linked to the challenge that poses the implementation of teleworking for a big share of the workforce. Additionally, companies are implementing measures to mitigate the threats to the health of their employees.

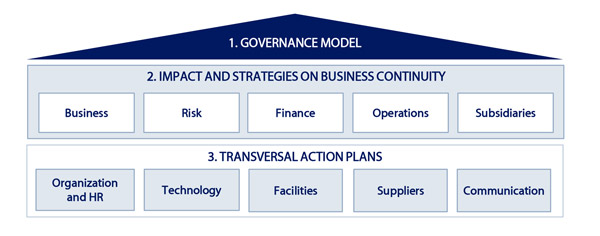

In order to face this adverse scenario and ensure business continuity, companies must carry out and coordinate action plans on multiple fronts (HR and Organisation, Technology, Facilities, Supplies and Communication) under a governance model that helps manage the crisis.

This paper gives an overview of the measures taken by institutions, with focus on Europe and America, as well as the impact that these will have in different sectors and in particular, the financial sector. The main objective of the paper is to present specific proposals for action to facilitate the management of the crisis and ensure business continuity of companies.

For more information, click here to access the full document in pdf (also available in Spanish and Portuguese).

Related documents: COVID-19: reactivation plan | Actions to mitigate the impact of COVID-19 on the banking sector.