The market related to asset digitization has boomed in recent years and presents itself as a future opportunity. The cryptocurrencies were the origin of this market that, thanks to the increase in tokenization solutions, is in continuous expansion.

cryptocurrencies were born as private digital or virtual currencies that, unlike conventional or fiat currencies (EUR, USD, GBP, etc.), were not issued by a central authority. In this case, since their supply is not controlled by a government, their price is determined by the law of supply and demand. As of today, many central banks are exploring alternatives for the issuance of "public" digital currencies backed by the central bank itself.

The first cryptocurrency was Bitcoin (created in 2009) and they have been growing, there are now more than 10,000 cryptocurrencies in circulation.

Their use, like conventional currencies, is not restricted to being means of payment, but they are also used as means of investment or speculation or as a source of financing or incentive for digital projects.

The basic elements for trading cryptocurrencies are the digital wallet with fiat currency, the digital wallet that will guard the cryptos and the set of orders launched to the exchanges, Peer To Peer (P2P) environments or networks of services where the transactions will be executed.

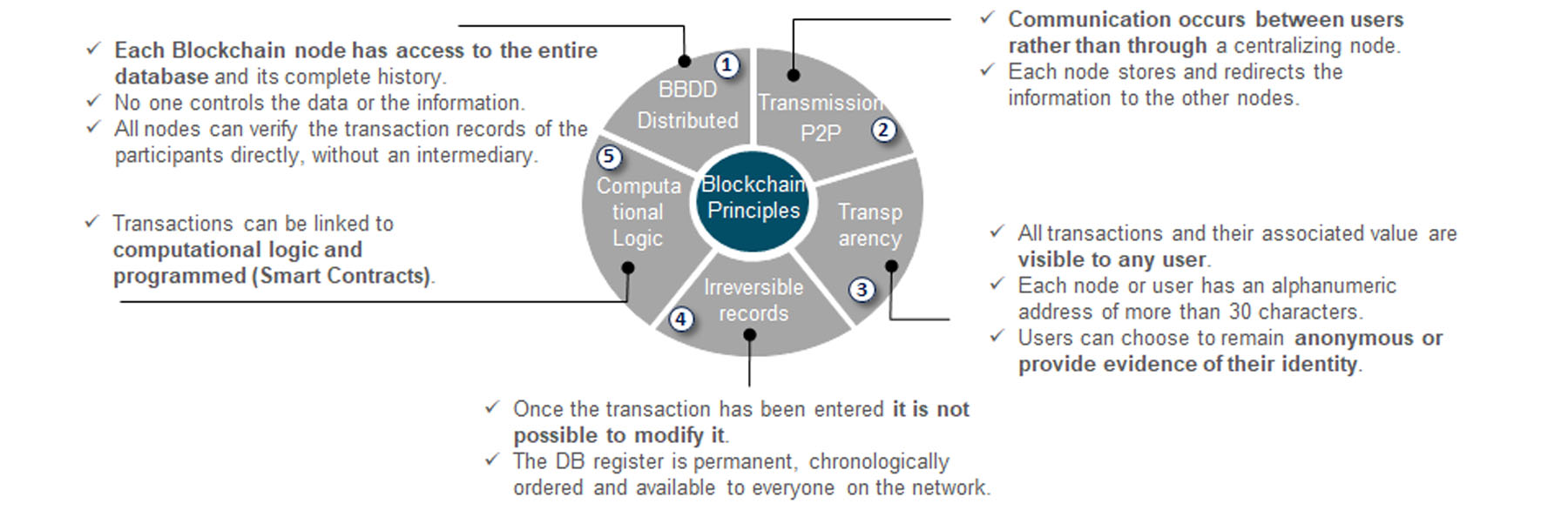

The underlying technology in the development of cryptocurrencies is the blockchain, a distributed and decentralized database, based on cryptographic algorithms that contribute to data protection and privacy.

On the basis of blockchain technology, products that were previously marketed in a more traditional way have also been digitized and likewise new products are emerging:

- Goods non-fungible encompassed as NFT product (non fungible token).

- Traditional capital market products such as: bonds, ETFs or structured products.

- And more recently, digital currencies issued by central banks themselves called CBDC (Central Bank Digital Currency).

For more information see the full document.