Challenges, trends and solutions to streamline the payments ecosystem

Video: Payments ecosystem

Download document

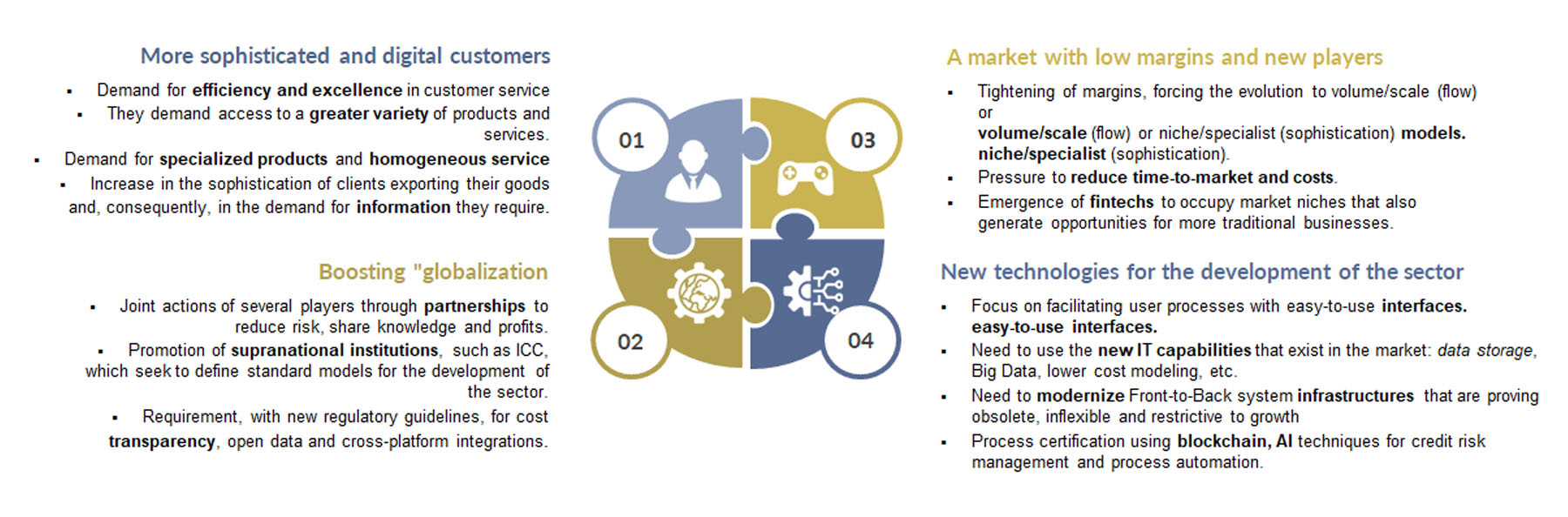

The provision of payment services, the bedrock underpinning the exchange of monetary flows in our financial system, is subject to continuous transformation.

The provision of payment services takes place in avery demanding competitive environment.

Customers, both businesses and individuals:

- Are increasingly sophisticated and digital.

- Previously valid payment solutions are no longer valid and it is necessary to offer a variety of products and highly specialized services (instant payments, online conversion between currency pairs, digital wallets, mass payments through direct connections between technology platforms, etc.).

- Technology becomes the basis for transforming the process.

- Entities tend toward apification of services and systems.

- An integrated experience between the different market players is sought (integrated payments, Account to Account payments, QR payments).

In the constant quest to improve the efficiency and control environment of the payments ecosystem, the industry has been developing new solutions aimed at:

- Reducing the time required for monetary flows to complete their end-to-end cycle.

-

- Increase the levels of control and securityof the ecosystem as a whole.

Within these solutions, the use of:

- Virtual Accounts as a method of organizing balances and transactional information within a traditional "physical" bank account.

- Technological platforms to carry out a digital management of payments and collections, with more secure and scalable standards and allowing real-time execution of payments.

- Payment hubs, which make it possible to evolve from an "island" model with multiple participants in the payment circuit to a collaborative and centralized model.

- Integral platforms where the different payment service players focus on delivering value to their customers through the personalization of their offers.

Without forgetting that it is essential to ensure a robust control model, given how sensitive and critical these types of services are for both the entities that offer them and those that demand them.

For more information see the complete document.

The line of evolution set by regulators, aimed at increasing the transparency of the ecosystem and competition in the provision of this type of services has facilitated the emergence of new players: fintechs, bigtechs, paytechs and neobanks, which occupy specific market niches and generate opportunities both for themselves and for more traditional businesses.

In a context like the above: