Payments Ecosystem Transformation: Evolution, Challenges and Opportunities

Video: Payments ecosystem

table of contents

Complete document

The provision of payment services is a fundamental pillar for the exchange of monetary flows within the financial system. This activity is undergoing continuous transformation, driven by a highly competitive environment. In this context, all participants in the ecosystem -understood as the actors, infrastructures, standards and technologies that facilitate the transfer of economic value between end users, both in retail and wholesale payments – are impacted to varying degrees by the changes resulting from this transformation. This includes central banks, financial institutions, non-bank service providers, technology operators, and users.

The payments ecosystem: An evolution tied to the advancement of civilization and driven by innovation

The history of the payments ecosystem reflects the economic and social progress of mankind. From the most rudimentary forms of barter to automated digital systems, this area has accompanied the development of civilization. In the 21st century, it has become one of the most dynamic areas within the financial and technological sphere, catalyzing new forms of economic exchange.

Various international organizations, such as the Bank for International Settlements (BIS), have highlighted this transformation in their reports, pointing out both the opportunities and the associated risks. According to the BIS, the new paradigm calls for the development of an efficient, secure and interoperable payments infrastructure that contributes to monetary stability and financial inclusion.

The COVID-19 pandemic accelerated this evolution, driving the adoption of contactless payment methods, the growth of e-commerce and the intensive use of digital financial services. This acceleration has marked a transition from a traditional banking-centric model to a more diverse, decentralized and collaborative ecosystem, comprised of an interconnected network of institutions, technology companies, regulators, infrastructure providers and end users.

Today's payment ecosystem: an attractive and growing ecosystem

Today's payment ecosystem is characterized by the coexistence of multiple players and technologies. These include the use of cash, traditional card schemes (such as Visa or Mastercard), bank transfer systems, digital wallets, mobile payments using QR codes, as well as a growing number of innovative solutions, such as payment platforms integrated into social networks or marketplaces.

This diversity of players and technologies makes the payments ecosystem a dynamic, attractive and constantly expanding environment, with four key areas of evolution according to data from the International Monetary Fund:

- Changes in deposit and lending patterns: While the number of bank accounts has increased globally, many regions have seen a decline in the value of deposits and loans. For example, in the Middle East and Central Asia, the ratio of loans to GDP fell from 59% in 2021 to 55% in 2022. This decline can be attributed, in part, to the reversal of policies implemented during the COVID-19 pandemic to encourage lending, as well as a tightening of monetary policy in response to rising inflation.

- Transformation in the means of access to financing: In recent years, there has been a significant shift in financial access channels. While traditional access points, such as ATMs and bank branches, are in decline, non-traditional platforms, such as retail agents and mobile money operators, are experiencing remarkable growth.

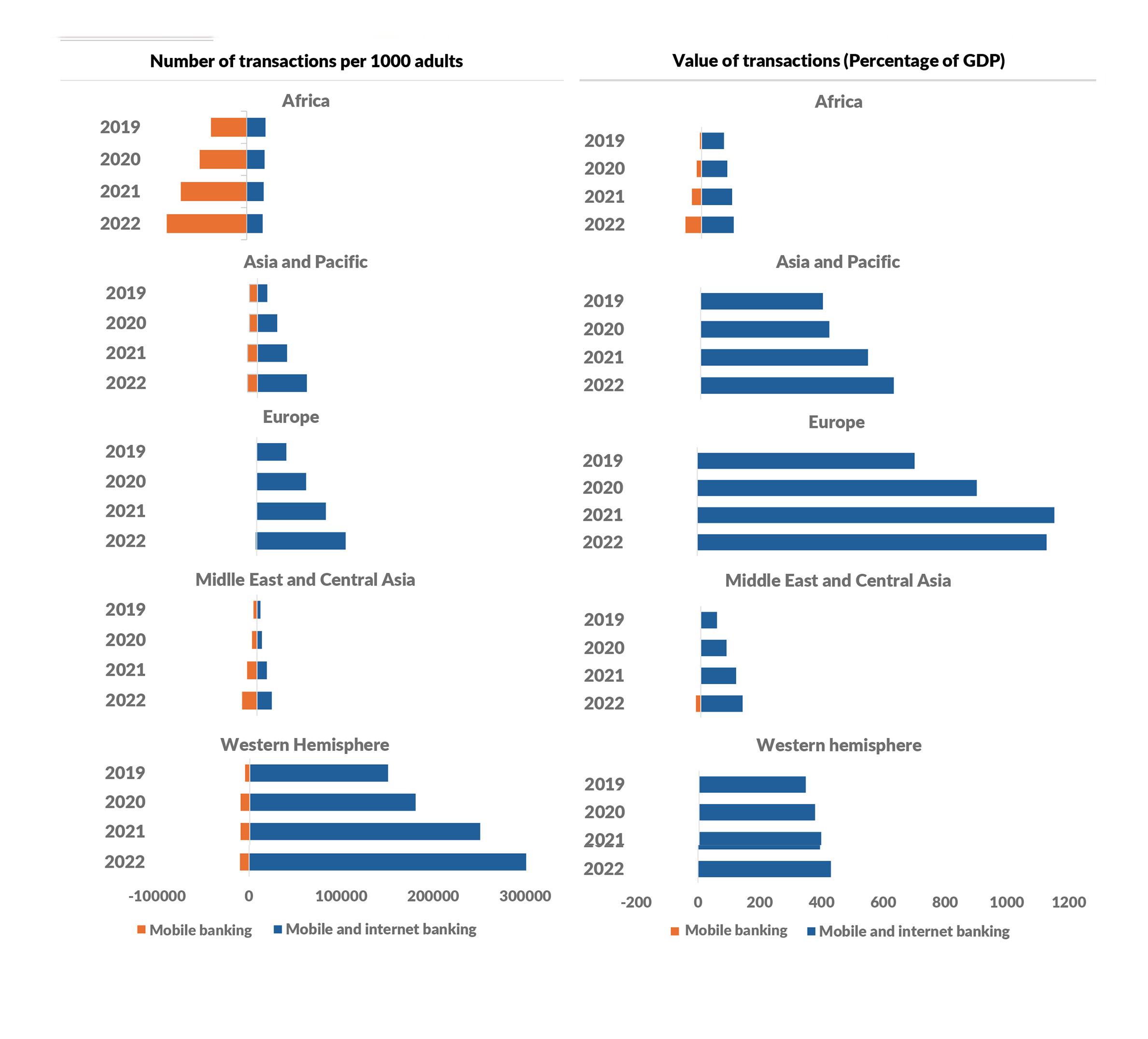

- Sustained growth in digital financial services:In most regions, digital financial services continue to expand in terms of both volume and number of transactions, consolidating their position as a key trend in the global financial system. The proliferation of digital channels has inevitably led to an increase in their use, evidenced by the growing number and volume of digital financial transactions. For example, in Africa - a region that is a mobile money powerhouse - the value of these transactions rose from 26% to 35% of GDP between 2021 and 2022. In Europe and the Western Hemisphere, thre has been a shift in preference toward mobile and online banking, with the volume of of digital banking transactions per 1,000 adults growing by over 20 % in 2022.

- A historical overview of the evolution of the payments ecosystem, highlighting the key drivers of transformation that have compelled both payment service providers and users to adapt in order to stay ahead in the provision and use of such services.

- A description of the current ecosystem, addressing both the market perspective (supply and demand of payment services) and the regulatory framework that governs it.

- An analysis of the transformation challenges faced by the various players in the ecosystem, considering the growing level of digitalization and technological sophistication of companies and individuals – factors that have rendered many traditional payment solutions obsolete.

- A reflection on the opportunities arising from such profound transformation, both for traditional players – those who have historically led the ecosystem – and for new entrants, whose nature, scale or technological capabilities position them to become relevant players in the ecosystem.

Figure 1. Evolution of transaction volume and value per transaction by region from 2019 to 2022

|

Source: Financial Access Survey and IMF staff calculations.

Challenges of an expanding ecosystem

The exponential growth of the payments ecosystem raises fundamental questions around its security, governance, resilience and accessibility. One of the main challenges is to maintain user trust in a landscape where cyber-attacks, identity theft and digital fraud are on the rise, and where reliance on external dependencies – such as power, internet connectivity, mobile communications networks, data center infrastructure, DNS and digital certificate services – is fundamental for a fully digital environment.

Likewise, the irruption of new technologies, such as artificial intelligence and blockchain technology, has given rise to disruptive payment models, for which regulatory frameworks are still evolving.

Among the most transformative innovations has been the emergence of cryptocurrencies. Originally conceived as decentralized alternatives to fiat money, cryptocurrencies such as Bitcoin and Ethereum have evolved into digital assets. Although they are not yet widely used as an everyday means of payment, their impact on the global financial architecture has been significant.

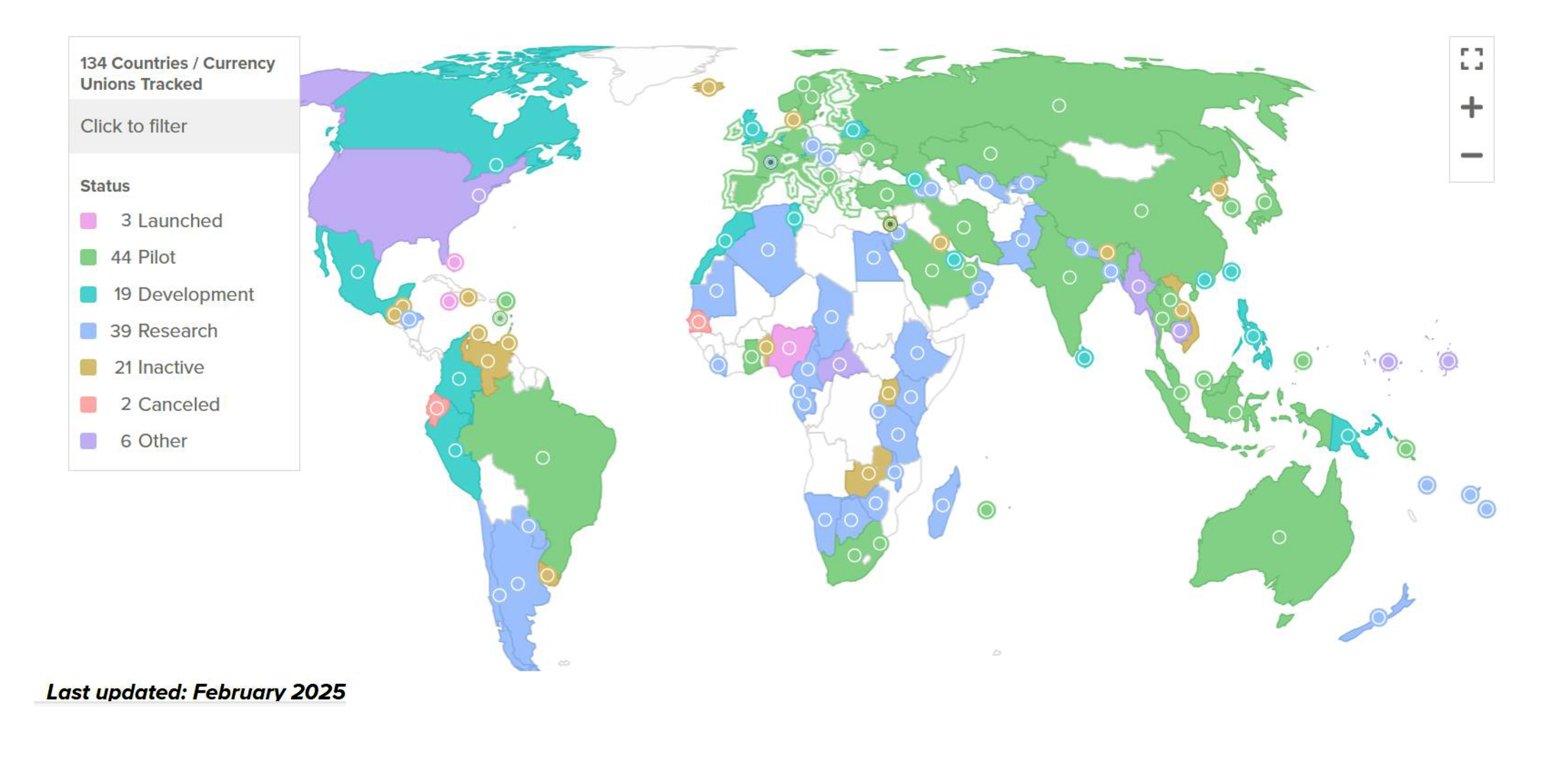

In response to this phenomenon, numerous central banks are exploring the development of Central Bank Digital Currencies (CBDCs) as a regulated alternative to private cryptocurrencies. The Atlantic Council's CBDC Tracker3 provides a detailed and up-to-date visualization of countries that are researching, developing or implementing such digital currencies. According to the most recent data, 134 countries - collectively accounting for 98% of global GDP - are considering launching a CBDC. In May 2020, that number was only 35 countries (see figure 2).

Figure 2: Status of CBDC issuance around the world.

|

Source: CBCD tracker del Atlantic Council.

On the other hand, financial inclusion remains a pending goal in many regions of the world. Digital, economic and cultural divides continue to exclude millions of people from the formal payments system, limiting their full participation in the global economy. Finally, regulation and oversight of the payments ecosystem faces the challenge of adapting to an unprecedented pace of innovation without slowing down its development. The balance between fostering competition and protecting the consumer is becoming increasingly complex in an environment where the boundaries between technology and finance are becoming increasingly blurred.

How to help understand the nature of the changes?

The complexity of the payments ecosystem makes it difficult to fully understand the scale and nature of its underlying dynamics. This document aims to clarify these dynamics through a structured informative approach:

TABLE OF CONTENTS

Introduction

Executive overview

The payment ecosystem: where do we start from?

Challenges faced by payment ecosystem participants

Opportunities for payment ecosystem participants

Conclussions

Glossary and bibliography