Why SiRO?

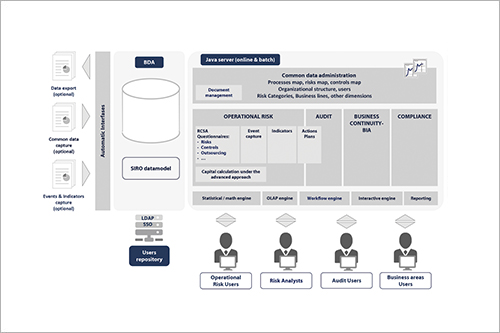

SIRO is Management Solutions' tool for GRC and business continuity management in regulators, financial institutions and large corporations.

- Core: supports the administration of shared data (organization, processes, risk categories, business lines, etc.) for full system management.

- Risk Management: integrates all functionality necessary for risk management (advanced self-assessment of risks and controls, indicators and alerts, incident/event management, action plans, specific reporting and dashboards).

- Compliance: allows registration of degree of compliance with rules and regulations, setting of controls, monitoring of risk levels and application of action plans.

- Business Continuity: supports BIA analysis to determine critical processes, testing of IT contingency plans and business recovery plans in contingency situations, registering of problems found and setting of action plans.

- Audit: supports audit plans and management of the work necessary for their implementation, management and monitoring of groups of auditors, and recording of findings, recommendations and action plans necessary to address any shortcomings.

- Internal model-based capital and insurance portfolio calculation engine: supports more advanced calculation than the basic version of SIRO.

Advantages

Operational Risk architectures based on integrating separate specialist applications are problematic (coherence, interfaces, extra costs, substantial effort to reconcile information). An integrated and fully configurable solution provides risk managers with a global picture of risk.

SIRO's scope has evolved from Operational Risk management to include governance, internal control, compliance, modeling and optimization of the insurance portfolio in large industrial corporations as well as specific management of IT, legal, reputational and outsourcing risks.

SIRO'S FUCTIONALITIES

Common data management

Processes, Risks, Controls, Organizational Structure, Users and Roles, Risk Categories, Business Lines, etc.

Features

Risk Control - Self Assessment (RCSA)

Action Plans

SIRO-ARE

(Advanced Risk Engine)

Operational Risk - Loss Database

Indicators

Insurable Risk/Insurance

Portfolio Optimization

Business continuity/BIA analysis

Cross-functional features

Technical architecture

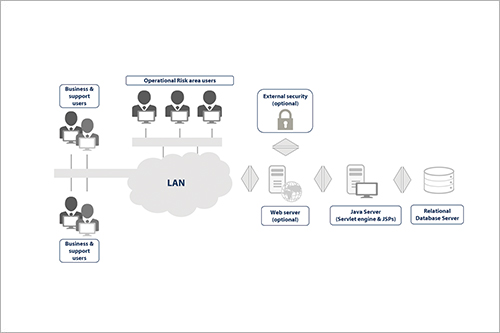

SIRO is offered in two forms: Software as a Service (cloud), guaranteeing maximum security and service levels, and on-premises, with a customizable architecture designed to adapt to the organization's specific technology.

Three-layer architecture

- A Java server that implements a servlet container and a Java Server Pages (JSP) engine, of which there are versions for almost all current Operating Systems: WebSphere, Tomcat, WebLogic, etc.

- A Relational Database Management System (RDBMS): Oracle, SQL Server, etc.

- A web server (optional), usually part of the intranet infrastructure, where user authentication is delegated.

- Client: user PC with a web browser.

Technical features

- Developed independently of the operating system, Java Application Server and Relational Database Management System used.

- Security can be delegated to the existing corporate Single Sign On/Intranet architecture.

- Protection of URLs and against malicious access.

- Corrective maintenance and support with flexible Service Levels tailored to each individual organization.

Credentials

The different SIRO modules are widely implemented in organizations of various kinds and endorsed by Regulatory Authorities.

Among the types of entities in which SIRO is installed, Central Banks and regulatory and supervisory bodies, large international financial groups, local financial entities, insurance companies, corporations in industrial sectors, etc. stand out.

Regulatory and supervisory bodies

Financial institutions with an international presence

Financial institutions with a local presence

Insurance companies and other corporations

Management Solutions is an international consulting Firm whose core mission is to deliver business, risk, financial, organization and process-related advisory services, targeted at both functional aspects and the implementation of related technologies.

Management Solutions currently has a multidisciplinary team (functional, mathematical, technical and systems integration) of more than 3,300 professionals, and operates through 41 offices (17 in Europe, 20 in the Americas, 2 in Asia, 1 in Africa and 1 in Oceania) from where we regularly serve clients that operate in more than 50 countries across five geographical areas (Europe, Americas, Asia, Africa and Oceania).

Management Solutions' differentiating factor lies in its in-depth knowledge of the businesses in which its clients operate and in its high degree of sector-specific and functional specialization.

For further information: www.managementsolutions.comFor further information

Eduardo Pérez-HickmanPartner at Management Solutions

eduardo.perez-hickman@msspain.com

Jorge Sánchez Rojas

Manager at Management Solutions

jorge.sanchez@msspain.com