Why MS2?

MS2 - Management Sustainability Solutions is a technological solution for the measurement of risks associated with climate change, adapted to the particularities of the financial and insurance sector.

MS2 - Management Sustainability Solutions is a tool aimed at financial institutions and insurance companies that uses various methodologies for measuring the physical and transition risks associated with climate change, as well as estimating financed emissions. For this, climate scenario analysis methodologies are implemented based on internationally accepted models. The tool covers different portfolios and products, providing short and long term estimates based on scenarios developed by research institutes and made available by international organizations.

MS2 thus responds to industry needs such as:

- Modeling the potential impact of climate change risks on the value of financial or physical assets, over different time horizons and under different scenarios, for different geographies.

- MS2 also serves as a basis for ICAAP and regulatory or internal stress testing exercises, and supports compliance with specific regulatory requirements.

- Estimating financed emissions based on available information on the real and economic activity of counterparties, and setting the decarbonization targets for the different portfolios.

- Developing mechanisms for data and scenario processing. MS2 autonomously handles requests for physical risk scenario data, incorporating the physical and transition scenarios generated from IPCC and NGFS data.

- Obtaining aggregated information and indicators for strategic and management decision making.

In addition, MS2 has been developed in a modular format, with opensource technology, and with an architecture that allows an agile integration in different technological environments, either on-premises or in the cloud. This approach also allows the tool to be adapted to integrate other methodological alternatives, in cases where the client has already developed its own models.

This makes MS2 a flexible tool that adapts to the needs of each client, and allows you to obtain results for their subsequent analysis, use and integration into the management process.

MS 2 FUNCTIONALITIES

The MS2 tool enables scenario-based impact analysis of climate risks on credit portfolios, and allows you to estimate financed emissions and to set targets

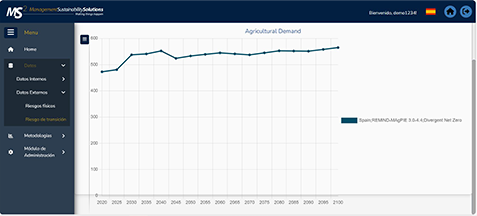

Obtaining climate scenarios

| Selection of physical risk and transition scenarios and their associated variables for scenario analysis. MS2 has a set of transition scenarios (NGFS) and physical scenario variables (IPCC), which are updated according to the data published by these organizations. |

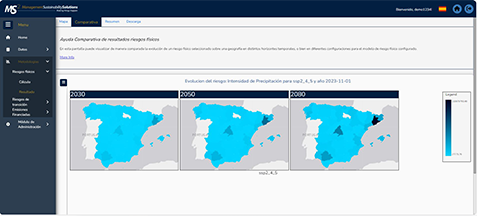

Physical risk analysis

| Analysis of the different physical event scenarios (floods, fires, storms, etc.) on the risk parameters (PD / LGD) of corporate portfolios or portfolios secured by real estate. This analysis uses the geolocation of physical assets. |

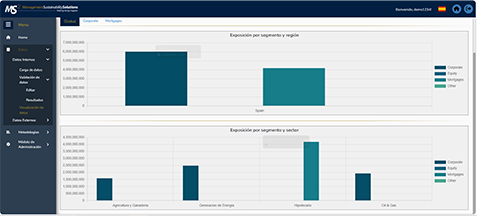

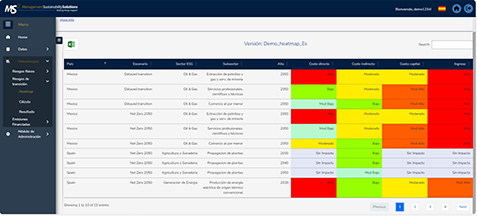

Transition risk analysis

| Analysis of the impact of transition scenarios (NetZero2050, Delayed transition, etc.) on the risk parameters (PD / LGD) of company portfolios. This analysis is carried out at the sector level and the geographical level. |

Financed emissions

| Estimate of current emissions financed through loan or investment portfolios. This estimate is made using the PCAF methodology. Setting of financed emission targets by sector and geography. |

MS2 benefits

The use of the tool allows for a quick, efficient and traceable calculation of the impact of climate risks on business strategy and risk parameters.

MS2 Structure

The tool is divided into two sections: (i) Data Processing, which allows climate scenarios to be incorporated, and (ii) Methodologies, which includes physical risk and transition scenario estimation as well as the emissions module.

Data Processing

The purpose of this section is to make available in the tool the data required to run the methodologies, both internal (credit and investment portfolios) and external (physical and transition scenarios).

This section allows you to implement the following functionality:

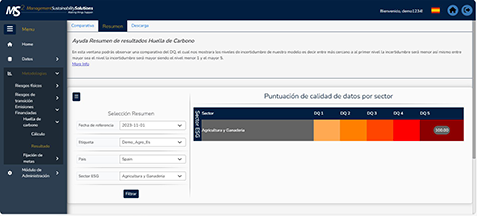

Methodologies

This section is used to run methodologies and visualize results. The built-in methodologies and dashboards can be adapted to the requirements of the organization during the installation process.

Results at a granular level are kept in the database, ensuring their historization. These granular data are available for download by the organization, thus facilitating their use in other management processes (materiality, stress testing, reporting, etc.).

Methodologies have been structured into three modules with the following functionality:

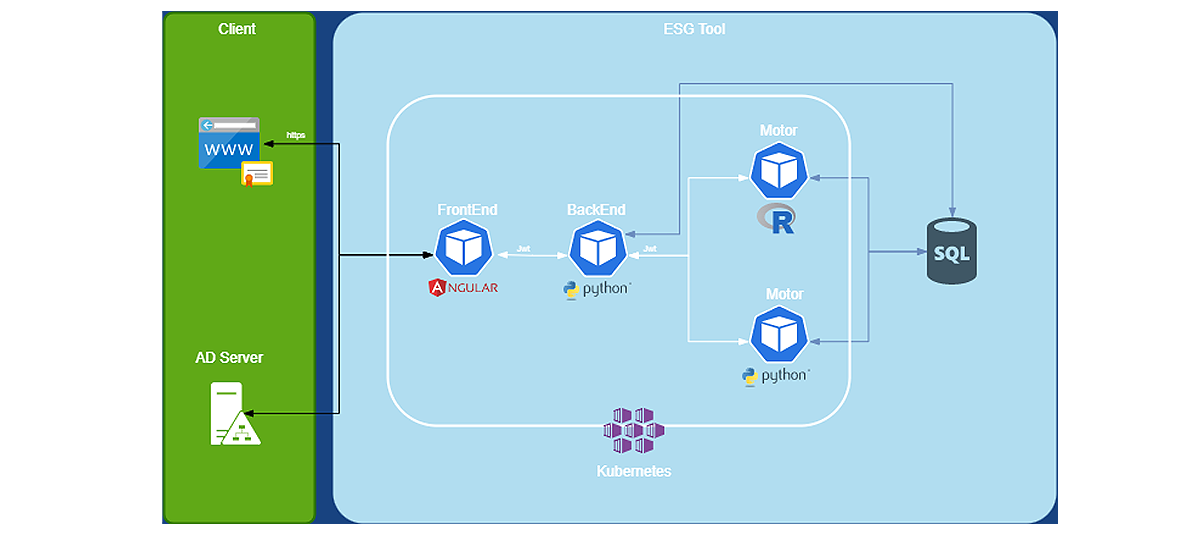

Technical architecture

MS2 considers three elements (database, back-end and front-end) including security best practices, encryption algorithms, active directory integration and Kubernetes structure (for modularization of functionalities) and can be installed both on-premises and in the cloud.

Database for information storage

Back-end

Front-end

CREDENTIALS

MS has extensive experience in climate risk across multiple sectors, particularly in financial institutions. We have developed numerous projects with the Sustainability and ESG Risk areas of many of the world's leading GSIBs and DSIBs. This allows us to benchmark and compare with other financial institutions.

Management Solutions provides differential value in the field of climate risk measurement:

- We have broad experience in the development, validation and implementation of models and algorithms used to analyze climate risks in various industries and sectors.

- We have an R&D team specialized in defining and implementing methodologies for climate and environmental risk measurement (impact of physical risk and transition scenarios on portfolio parameters, impact of physical risk on own buildings, calculation of financed emissions, portfolio alignment and targeting, etc.).

- We have extensive experience in financial sector regulation and have a Regulatory Observatory that provides in-depth knowledge of regulatory requirements related to sustainability and climate change risks.

- We have developed physical risk measurement and valuation projects, including definition and implementation of methodologies, obtaining results, conducting climate stress tests, analysis of indicators, ICAAP integration and integration into the management process.

As a result of this expertise, Management Solutions has implemented the MS2 tool in all the countries where it operates.

Management Solutions is an international consulting firm, focused on business, finance, risk, organization, technology and process consulting.

Management Solutions currently has a multidisciplinary team (functional, mathematical, technical and systems integration) of more than 3,300 professionals who carry out their activities through 45 offices (20 in Europe, 21 in the Americas, 2 in Asia, 1 in Africa and 1 in Oceania), from where we regularly serve clients that operate in more than 50 countries.

We create value propositions, committing ourselves to their effective implementation, exceeding the expectations of our clients and becoming a trusted partner

Management Solutions' differentiating factor lies in its in-depth knowledge of the businesses in which its clients operate, and its high level of sector and functional specialization.

In order to meet its clients' needs, Management Solutions has structured its practices by industry and business line, grouping a wide range of competencies.

For more information: www.managementsolutions.comFor further information, please contact:

Soledad Díaz-Noriega

Partner at Management Solutions

soledad.diaz-noriega@managementsolutions.com Manuel Ángel Guzmán

Partner at Management Solutions

manuel.guzman@managementsolutions.com José Ángel Aragón

Partner at Management Solutions

jose.angel.aragon@managementsolutions.com