WHY PALADIN?

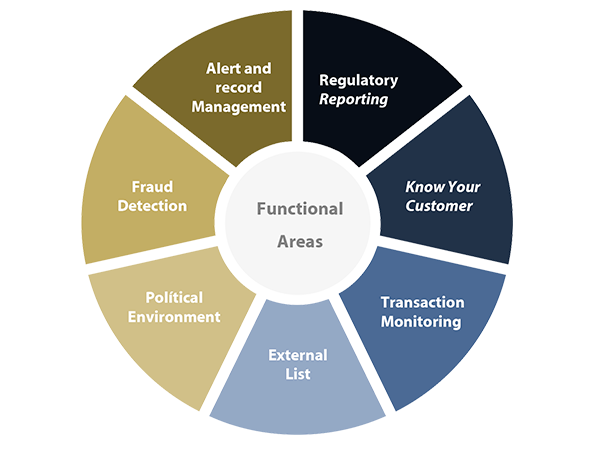

Paladin is the anti money laundering compliance and fraud detection tool with the broadest functional scope on the market today, providing the functionality required by a financial institution’s entire AML unit in a single environment.

Paladin is Management Solutions’ Anti Money Laundering Compliance and Fraud Detection IT solution.

Designed based on industry best practices, Paladin features a comprehensive set of benefits for end users through its user-friendly interface and customizable fraud detection and AML modules.

Paladin’s main features:

- Integration across the different AML functional modules, building a unique AML risk profile for each client.

- Monitoring of fully customizable transaction scenarios that can be created from scratch directly by the end user.

- Scoring models can be parameterized online and in batch form, both for the AML-Know Your Customer(KYC) function and for the fraud detection function.

- Sanctions lists and politically exposed persons (PEP) lists are integrated into Paladin data structure allowing the organization to screen and track business relationships.

- Comprehensive data model covering all the data needs of a standard Financial Intelligence Unit (FIU).

- Regulatory and internal information can be adapted to the specific reporting framework of any geography or institution.

- Alert and case management module can be adjusted to the specific analysis workflow implemented by each individual organization.

Benefits

Paladin solves the functional and it needs of financial institutions in terms of AML compliance and fraud detection without the need for long and complicated internal adaptation and transformation processes.

User benefits

Benefits for IT

Paladin functionalities

Functional integration of Paladin's different modules allows for specific control and monitoring of each risk source and each undeniable risk interconnection money laundering prevention.

Paladin's analysis has a three-pronged focus: all transactions involving the flow of funds, the customers involved and their relationship with individuals in sanctions lists or the political sphere.

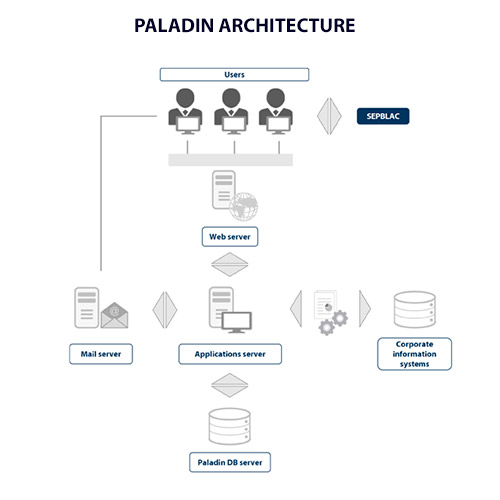

Technical Architecture

Paladin is based on three layers of architecture (user interface, business, and data storage) that meets industry standards and enables potential growth in performance needs.

Three-layer architecture

- User interface: Paladin's web application is accessed via Internet Explorer and documents are created on a desk top environment. Warnings can be automated depending on the organization's settings.

- Web server (and application server): management of both business processes and technical system processes (user requests, data sourcing, etc.). Runs on the Microsoft.NET framework and Microsoft Integration Services processes.

- Database server: supports Paladin's persistence layer. Runs on Microsoft SQL Server 2005.

Tailored to the customer’s technology requirements

- Third-party systems are integrated through the deployment of a web service providing access to the system's basic functionality.

- Mail submission parameterization in the production of warnings in business/data upload processes.

- Sensitive information encryption parameterization through proprietary algorithm.

credentials

Financial institutions using Paladin are assured reliability and security when it comes to Bank of Spain supervision and external audits on money laundering prevention.

During over fifteen years of existence, Paladin has been implemented in more than fifteen financial institutions of different types.

National financial groups

Large, medium and small commercial banks

Credit cooperatives

Remittance entities

Management Solutions is an international consulting Firm whose core mission is to deliver business, risk, financial, organization and process-related advisory services, targeted at both functional aspects and the implementation of related technologies.

Management Solutions currently has a multidisciplinary team (functional, mathematical, technical and systems integration) of more than 3,300 professionals, and operates through 41 offices (17 in Europe, 20 in the Americas, 2 in Asia, 1 in Africa and 1 in Oceania) from where we regularly serve clients that operate in more than 50 countries across five geographical areas (Europe, Americas, Asia, Africa and Oceania).

Management Solutions' differentiating factor lies in its in-depth knowledge of the businesses in which its clients operate and in its high degree of sector-specific and functional specialization.

For further information: www.managementsolutions.comFor further information

José Ramón GorrochateguiPartner at Management Solutions

jose.ramon.gorrochategui@msspain.com

Antonio Tazón

Partner at Management Solutions

antonio.tazon@msnorthamerica.com