Why MIR?

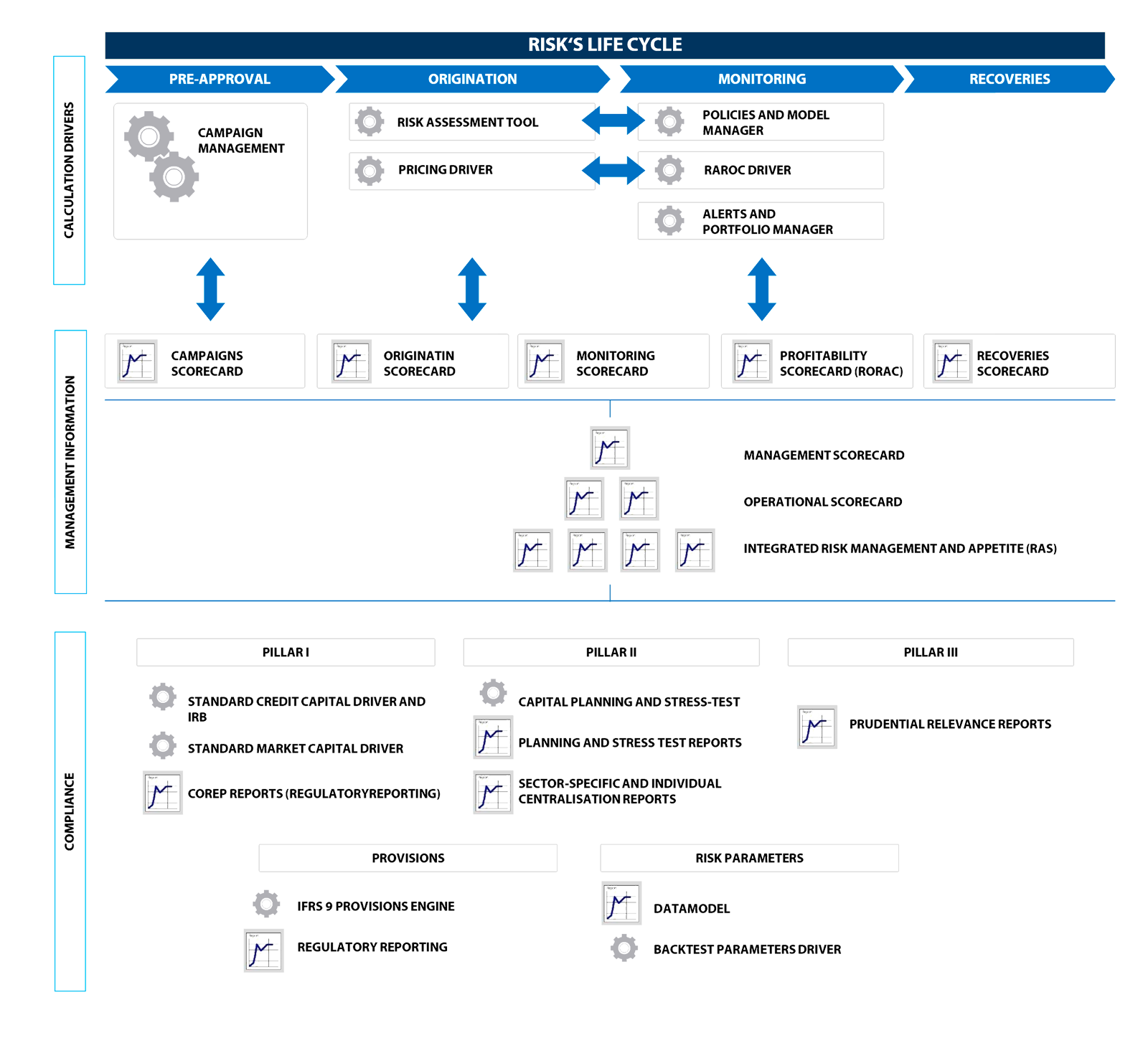

MIR is Management Solution’s answer to integrated risk management, unifying the regulatory and management views under the same customizable and modular platform.

- Incremental implementation methodology tailored to the priorities of each individual Entity.

- Multidimensional data model geared towards the exploitation (reporting) and functionality of accounting reconciliation.

- Uniqueness of information and calculation logic ensures consistency between the different reports generated.

- Solution adapted to best risk management practice and the specific regulatory requirements of European and American supervisory authorities (particularly Basel 3 for Capital and IFRS 9 for provisions).

Benefits

In a changing and competitive environment like the current one, an adaptable integrated risk solution becomes necessary, enabling a nimble decision making process and reducing the timings of putting into production new strategies.

Main characteristics

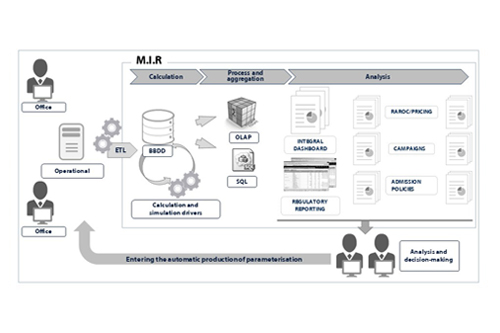

MIR Functionalities

MIR’s modular structure allows for incremental and customizable implementation to suit the needs of each client.

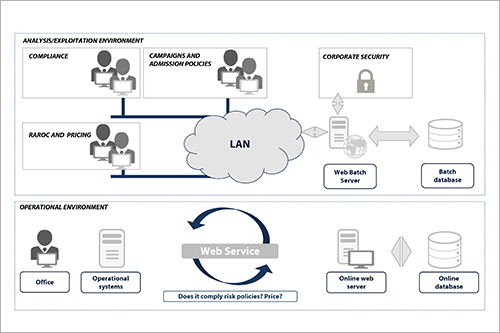

Technical Architecture

The MIR architecture only uses standard market technology in order to reduce technology costs.

Operational and Analytical Environment

- MIR provides to the different areas of the firm with an analysis and simulation environment, being able to nimbly produce new strategies.

- Bringing these strategies into production is done automatically through batch processes, which replicate the parameterizations established by the user.

Credentials

Reduced implementation timelines and support both from a technical and from a business point of view are two features highly valued by our clients.

The different modules in our MIR solution are implemented across some 100 financial institutions in Spain and Latin American countries, including:

Strongly diversified International Financial Groups with a presence in different geographies

Local Entities of different sizes

Multinational Financial Organisations, Development Banks and Microfinance Institutions

Investment Services Companies and Securities Firms

Management Solutions is an international consulting Firm whose core mission is to deliver business, risk, financial, organization and process-related advisory services, targeted at both functional aspects and the implementation of related technologies.

Management Solutions currently has a multidisciplinary team (functional, mathematical, technical and systems integration) of more than 3,300 professionals, and operates through 41 offices (17 in Europe, 20 in the Americas, 2 in Asia, 1 in Africa and 1 in Oceania) from where we regularly serve clients that operate in more than 50 countries across five geographical areas (Europe, Americas, Asia, Africa and Oceania).

Management Solutions' differentiating factor lies in its in-depth knowledge of the businesses in which its clients operate and in its high degree of sector-specific and functional specialization.

For further information: www.managementsolutions.comFor further information:

José Luis CarazoPartner at Management Solutions

jose.luis.carazo@msspain.com

Jorge Monge

Partner at Management Solutions

jorge.monge.alonso@msspain.com

José Ángel Aragón

Partner at Management Solutions

jose.angel.aragon@msspain.com